PROS Announces 2013 First Quarter Results

Prospector Offshore Drilling S.A. announced its results for the three months ended 31 March 2013.

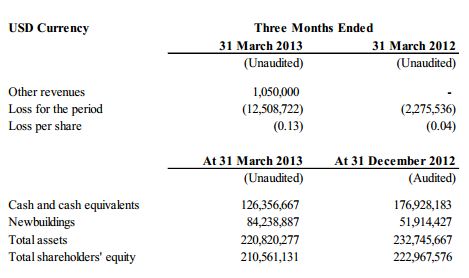

Summary of the 2013 First Quarter Results and Financial Position

As of 31 March 2013, the Company had contracts for the construction of a total of six high specification/harsh environment (“HS/HE”), Friede & Goldman JU2000E design, jack-up rigs and options for the construction of a total of three additional Rigs with Dalian Shipbuilding Industry Offshore Co., Ltd. (“DSIC Offshore”) and Shanghai Waigaoqiao Shipbuilding Co., Ltd. Shipyard (SWS), both located in China.

During first quarter of 2013, the Company recognized other revenue of USD 1.0 million from managing newbuild projects on behalf of a third party. The 2013 first quarter loss was primarily attributable to a provision recorded for the estimated loss from cash deposited in Cyprus, personnel costs, legal and professional fees, costs associated with managing the on-going shipyard projects and other costs associated with maintaining administrative offices. The operating expenses of USD 3.7 million were due to labor cost, training and travelling expenses associated with the rig activities in China and the Company’s operations shorebase in the U.K. The Company expects operating cost to increase later this year as it prepares to take delivery of its first rig. The administrative expenses of USD 3.6 million were incurred for personnel costs and professional fees associated with planning efforts regarding the Company’s Rigs scheduled for delivery in the third quarter of 2013.

More: CMA CGM Launch Three new Joint Services

On 25 March 2013, Cyprus and its international creditors reported that a stabilization package has been agreed with respect to the Cyprus banking crisis. A Company subsidiary at the time had approximately USD 8.1 million on deposit at Cyprus Popular Bank PCL (“Laiki Bank”). It is uncertain whether the Company will be able to recover the full amount on deposit at Laiki Bank. The Company’s potential loss at this time is unknown; the Company recorded a provision of USD 6.0 million during the first quarter 2013 to write-off a portion of its deposit at Laiki Bank.

As previously announced in December 2012, the Company was informed by DSIC Offshore that it was notified by Friede & Goldman Marketing BV (“F&G”) to suspend work on the Company’s Rigs’ jacking systems, pending testing. F&G is the engineering firm that has designed the jack-up and which has supplied the entire jacking system through their own sub-suppliers for PROSPECTOR 1 and PROSPECTOR 3 under construction at DSIC Offshore. Following a formal investigation, DSIC Offshore was notified that certain components in the F&G jacking system were not manufactured in accordance with the original design and will have to be replaced. As a result of the delays expected for the replacement components, PROSPECTOR 1, which was previously expected to be delivered in the first quarter of 2013, is now expected to be delivered in the third quarter of 2013. Furthermore, PROSPECTOR 3, which was previously expected to be delivered in the third quarter of 2013, is now expected to be delivered in the fourth quarter of 2013. The Company currently expects to take delivery of PROSPECTOR 5 and PROSPECTOR 6 in the first quarter and third quarter of 2014 respectively.

In March 2013, the Company exercised two of its option contracts with SWS and entered into turnkey construction contracts for the construction of two rigs (PROSPECTOR 7 and PROSPECTOR 8) with SWS in Shanghai, China. The Company currently expects to take delivery of PROSPECTOR 7 and PROSPECTOR 8 in the third quarter of 2015 and the first quarter of 2016 respectively

The Company has entered into a drilling contract with Total E&P UK Limited and Elf Exploration UK Limited (“Total”) for operations of PROSPECTOR 1 in the North Sea. Previously the Company expected to commence work on the Total contract in the second quarter of 2013. The Company has provided Total the updated schedule

, and has requested an extension for the commencement of the drilling contract. The Company expects PROSPECTOR 1 to commence work in the fourth quarter of 2013.

Preparations for the operations of PROSPECTOR 1 under the Total contract have already started, including hiring senior crew members and establishing operational and administrative support in the Company’s office in the UK. As a result of these efforts, the Company expects that operating and administrative expenses will be USD 6 million to USD 8 million for the second quarter of 2013, and slightly increase for the third and fourth quarter of 2013. In addition, the Company expects that project management and site supervision costs in DSIC Offshore and SWS in 2013 will be approximately USD 3 million per quarter.

Market Background and Outlook

Crude oil prices have remained strong in the first quarter 2013. Historically, crude prices provide the foundation for increasing offshore drilling activity, and, based on recent industry surveys, the major E&P companies’ capital budgets are expected to continue to increase over the next years.

The global market outlook for rigs, particularly those equipped for operations in the North Sea, remains favorable throughout 2013. There is a limited number of available rigs for the drilling programs that are anticipated until 2014 and 2015, which increases the demand for rig newbuilds to meet drilling needs. The contract duration and dayrates secured for HS/HE jack-ups were considerably higher than those for HS/non harsh-environment rigs throughout the first quarter 2013; the bifurcation in dayrates between these rig types is expected to increase further. Outside of the North Sea, the Company expects additional demand for new rigs in Asia, West Africa, the Middle East, and Mexico. The Company believes that the demand for deeper wells, wells in deeper water, wells with higher pressure and/or higher temperature or wells that require a larger or heavier casing profile provides opportunities that will differentiate its Rigs from most other jack-up.

With the advanced capabilities that the Company’s Rigs provide and the comparatively attractive terms of its Rig shipyard contracts, the Company believes that it is well positioned in a growing niche market with robust demand for the foreseeable future.

More: SinOceanic Shipping Releases 2013 Q1 Report

Cash Flow and Liquidity

The Company’s cash and cash equivalents totaled USD 126 million as of 31 March 2013, approximately USD 51 million lower than the balance of USD 177 million as of 31 December 2012.

The decrease was primarily attributable to an aggregate USD 30 million down payment on the construction contracts for PROSPECTOR 7 and PROSPECTOR 8. Additionally, the change in cash was impacted by a reclassification of USD 8.1 million cash deposited in Cyprus to restricted cash and the provision for uncollectible bank accounts, as well as the Company’s project management costs, mobilization costs, and corporate expenses incurred during the period. The Company is expected to close on a USD 129 million secured credit facility with the China Development Bank.

The Company is considering a similar financing facility for PROSPECTOR 3 and PROSPECTOR 5.

The actual terms in the financing facility will be subject to the terms in the initial drilling contract for the Rig. Management expects that it has sufficient funds to manage the Company’s working capital needs (including project management administrative expenses) until PROSPECTOR 3 and PROSPECTOR 5 are delivered from the fourth quarter of 2013 to the first quarter of 2014. There is no assurance that the Company will have the ability to raise this capital.

Shortlink: